While employee wellness programs have long been a staple of asset managers’ workplace offerings, the current pandemic appears to be bringing greater attention to their importance. In fact, industry experts believe wellness programs may play a significant role in helping investors get their finances back on track once the economic effects of COVID-19 start to fade.

But even before the pandemic, employers said they were looking to build wellness programs that went beyond retirement planning. According to Alight Solutions’ January report “2020 Hot Topics in Retirement and Financial Wellbeing,” 92% of employers said they wanted to expand their programs to support employees’ broader financial well-being.

But perhaps even more important than what the employers want is what employees want in a wellness program. According to a recent Retirement Advisor Council study, employees want plans that are:

- Accessible to anyone regardless of literacy, wealth, or earnings

- Delivered using a variety of touchpoints and media—online, in print, in person, and by phone

What the best plans have in common

We found that the most effective plans share one important characteristic: responsiveness. This means being able to understand and address members’ needs based on their specific financial goals, while also responding to broader factors affecting the lives of their participants.

While most asset managers recognize the importance of being responsive, three in particular stand out in how they’re helping address employee and employer concerns during the pandemic.

Prudential: More is better

Of the asset managers we reviewed, Prudential probably has the most extensive list of resources specifically catering to financial wellness right now. This includes its online resource center dedicated to helping organizations and investors navigate market volatility, manage stress, and understand the intricacies of the CARES Act.

Prudential also offers more industry-focused resources from its Financial Wellness Census, providing broader insights on financial attitudes and resilience as well as perspectives on how people are adapting to economic change.

It’s also worth pointing out that Prudential has begun offering resources and support related to life after the pandemic with “The Way Forward: Financial Life After Lockdown.”

This financial wellness education package includes virtual and in-person seminars, interactive online tools, videos, and articles—all aimed at helping employees with a broad array of financial topics, including budgeting, estate planning, insurance, and saving, as they relate to post-pandemic life.

- Stay ahead of the curve

While many asset managers are focused on helping people make it through the pandemic, Prudential is also proactively helping participants prepare their finances for life after the coronavirus. This may be especially relevant for younger participants, with 73% of millennials saying COVID-19 has forced them to rethink how they spend, save, and invest. - Reach participants where they are

According to the Retirement Advisor Council’s study, employee wellness programs need to be “usable by anyone, regardless of literacy, wealth, or earnings.” Prudential’s got participants covered with virtual and in-person events, videos to watch and articles to read, interactive tools, printable lists, and more.

Fidelity: Going virtual

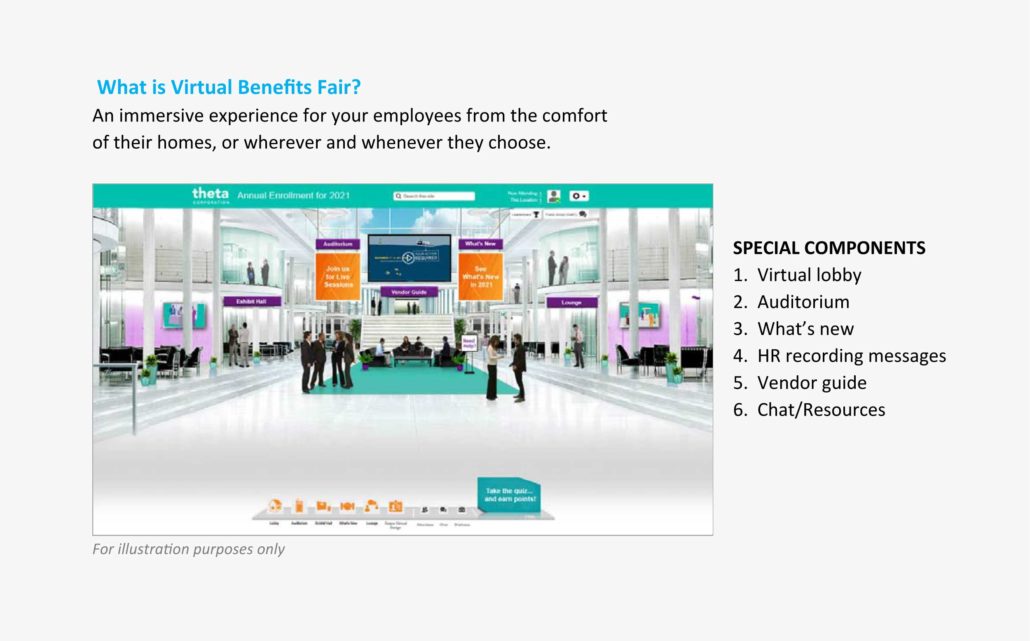

Fidelity is helping employers and employees navigate what could be a tough enrollment season with a virtual benefits fair.

With all the features of a traditional benefits fair—including a lobby, an exhibit hall, vendor booths, and an auditorium where live presentations and prerecorded videos can be viewed—Fidelity is making sure enrollment is still an immersive experience, despite the fact that it’s not happening in person.

- Present a familiar experience in a new way

Everyone’s been to a benefits fair in person, but far fewer have been to one online. To help employees get over the hurdle of this unique experience, Fidelity is doing its best to make it as familiar and easy to navigate as possible. - Capitalize on the advantages of virtual

While some may prefer the live experience, the advantage of a virtual benefits fair is that every bit of activity can be tracked. After the fair, employers receive reports to help highlight areas for future benefits communications.

BNY Mellon: Visualized value

Like most other asset managers, BNY Mellon has published a good deal of content regarding COVID-19 on its blog. The difference here is BNY Mellon has taken it one step further by providing it all in one convenient online location: the company’s LinkedIn page.

While a lot of corporate LinkedIn pages are updated somewhat infrequently, BNY Mellon has doubled down on the professional networking site as the center of its digital marketing efforts, typically posting three to five times a day. The firm’s consistency and diligence has paid off, with many of the posts getting hundreds of engagements

- Visualize it

By producing high-quality visuals with pull quotes and interesting statistics, BNY Mellon is making it easier to consume and share its posts, so the company’s high-quality content has a greater chance of impacting its target audience. - Bring it all together

While some may prefer the live experience, the advantage of a virtual benefits fair is that every bit of activity can be tracked. After the fair, employers receive reports to help highlight areas for future benefits communications.