Standing out with investors starts with knowing exactly who you are.

Your thinking and approach make you invaluable to investors — our 4D method can help ensure they see it that way, too.

Have you ever thought about what makes certain companies stand out from competitors? For some, it’s having the most recognizable name or most ubiquitous market presence. For others, it’s their breakthrough products and innovation. And for others still, it’s their brand’s ability to stand for something in consumers’ minds (quality or reliability, for example).

Knowing the exact qualities that help your firm stand out with investors — and making deliberate choices to accentuate those strengths and ward off threats — does not happen on its own. One way to help this process is by conducting a deep dive on your organization’s strengths, weaknesses, opportunities, and threats, an exercise known as a SWOT analysis.

Here’s how to use this process to make clear-eyed assessments on the internal factors (things you control) and external circumstances (things you don’t) that can lead to better decisions and greater opportunities to differentiate your firm.

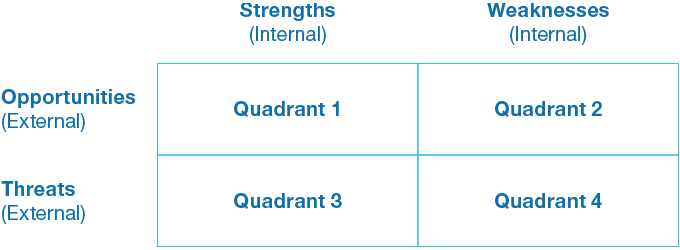

Setting up your SWOT

Think of this tool as a two-by-two grid where you plot your firm’s internal strengths and weaknesses as they pertain to external threats and opportunities.

To read more, complete the form >

Read the full article

"*" indicates required fields