For most Americans, the 2020 presidential election has amplified the strain they were already experiencing from the Covid-19 crisis. An American Psychological Association survey noted that 68 percent of American adults said “the upcoming U.S. presidential election is a significant source of stress in their life.”

This state of uncertainty makes it challenging for investors to understand the potential impact of the elections on their money. Recognizing that investors needed clear factual information now more than ever, asset managers stepped up communications efforts to cut through the noise.

Three leading asset managers in particular recently addressed this communications credibility gap with candor, clarity and fact. As if to say to investors, “We can get through this,” the three provided clear statistical evidence, compelling charts and one imaginative interactive tool to make the case that today’s electoral challenges aren’t likely to diminish the U.S. investment marketplace’s long-term prospects.

American Funds: Election Uncertainty Looks Increasingly Certain

Named one of the “most-read thought leaders” by advisors in a FUSE Research survey, American Funds’ Capital Ideas™ provides a variety of election year insights in a separate micro-site. The asset manager leads off with an exploration of market uncertainty: “To put things in perspective, the U.S. Economic Policy Uncertainty Index — which tracks a mix of economic, policy and media-related uncertainty measurements — has hit unprecedented levels in 2020. Investors may be wondering: ‘What could possibly come next?’”

In addition to summarizing a range of issues from mail-in ballots to how elections move markets in 5 charts, American Funds offers an advisor webinar, “What the election means to investors” for Continuing Education (CE) credits.

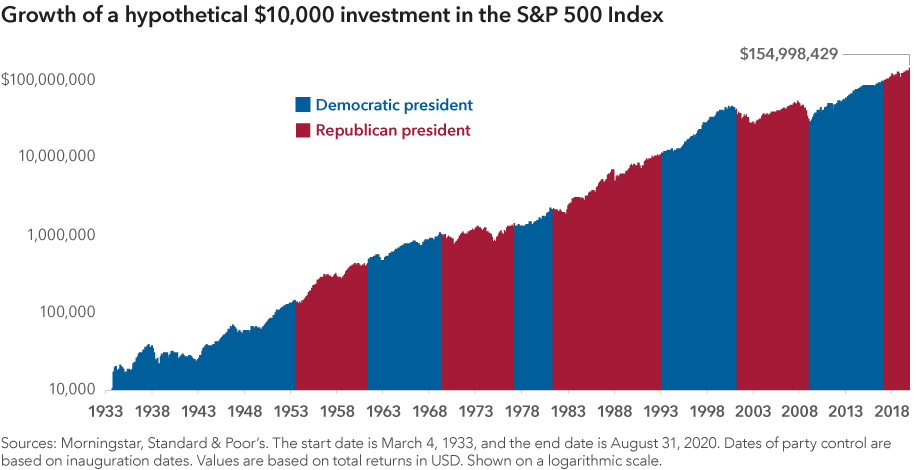

In its “Guide to Investing in an Election Year,” American Funds addresses top advisor questions and summarizes insights from “an analysis of over 85 years of investment data across 22 election cycles.”

WHAT ASSET MANAGERS ARE DOING WELL: AMERICAN FUNDS

-

Actionable Key Takeaways

The Guide is engaging, well-illustrated client-use presentation that leads to actionable key takeaways, for instance: “Markets have been more volatile during primary season, but tended to rise strongly thereafter,” and “Investors often sit on the sidelines during election years out of fear and uncertainty, but that’s rarely a winning strategy.” -

Transparent Case for Investing

The communications professionals and investment managers took the harder road this year in making a transparent case for investing through this year’s crises. American Funds perhaps summarized this view best in “3 Mistakes Investors Make During Election Years:” “Investing during an election year can be tough on the nerves, and 2020 promises to be no different. Politics can bring out strong emotions and biases, but investors would be wise to put these aside when making investment decisions.”

Fidelity: Dial-up an Election-Driven Financial Result

Fidelity offers a depth of resources in “Elections and Your Money: 2020 Elections and Your Personal Finances.”

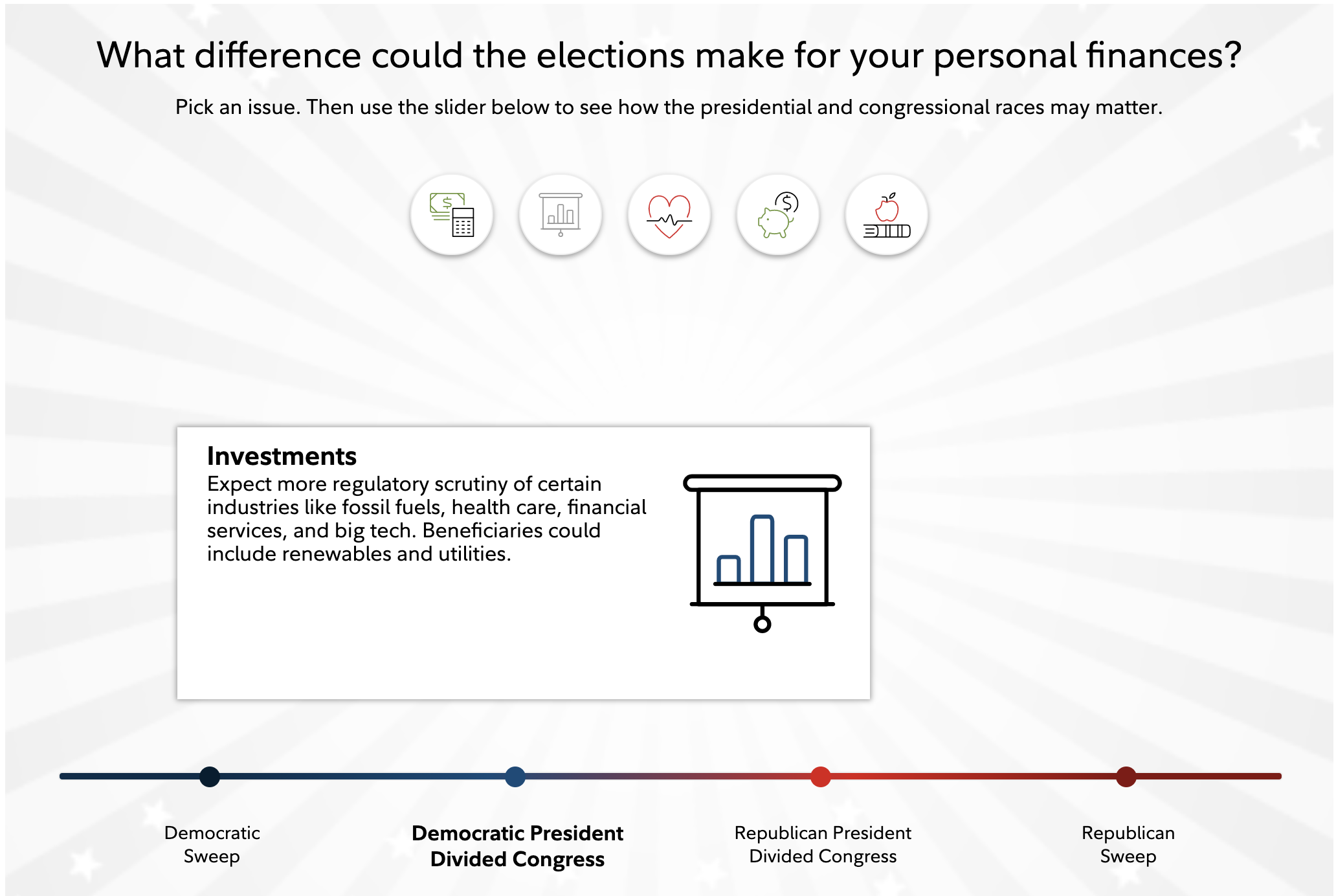

This microsite is filled with election-related market, sector, investment and personal finance insights, including two webcasts and a novel interactive tool. Fidelity also provides a side-by-side comparison of the candidates’ positions on taxes, federal spending, stock buybacks, tech, regulation, trade and retirement.

Fidelity also features an original, interactive tool that displays a variety of potential impacts based on different outcomes.

WHAT ASSET MANAGERS ARE DOING WELL: FIDELITY

-

Colorful Illustrated Charts

From colorful illustrated charts hat compare stock performance during presidential election years, to a webcast on election implications for portfolios and personal finances, Fidelity’s communications team cover this election season with depth and breadth. -

Crowd Pleasing Interactive Tool

The crowd pleaser is sure to be the interactive tool. Once you pick an issue like taxes, investments or retirement, you’ll find it hard to stop using this resource until you’ve fully explored the array of impacts a one-party sweep or divided government could have.

Alger Funds: Think “Beyond the Election”

Alger Funds has a message for investors studying every poll to position their portfolios based on who the next president will be: It’s not worth it.

Alger offers a collection of insights, What’s Moving the Markets: The Election on the impact of the election.

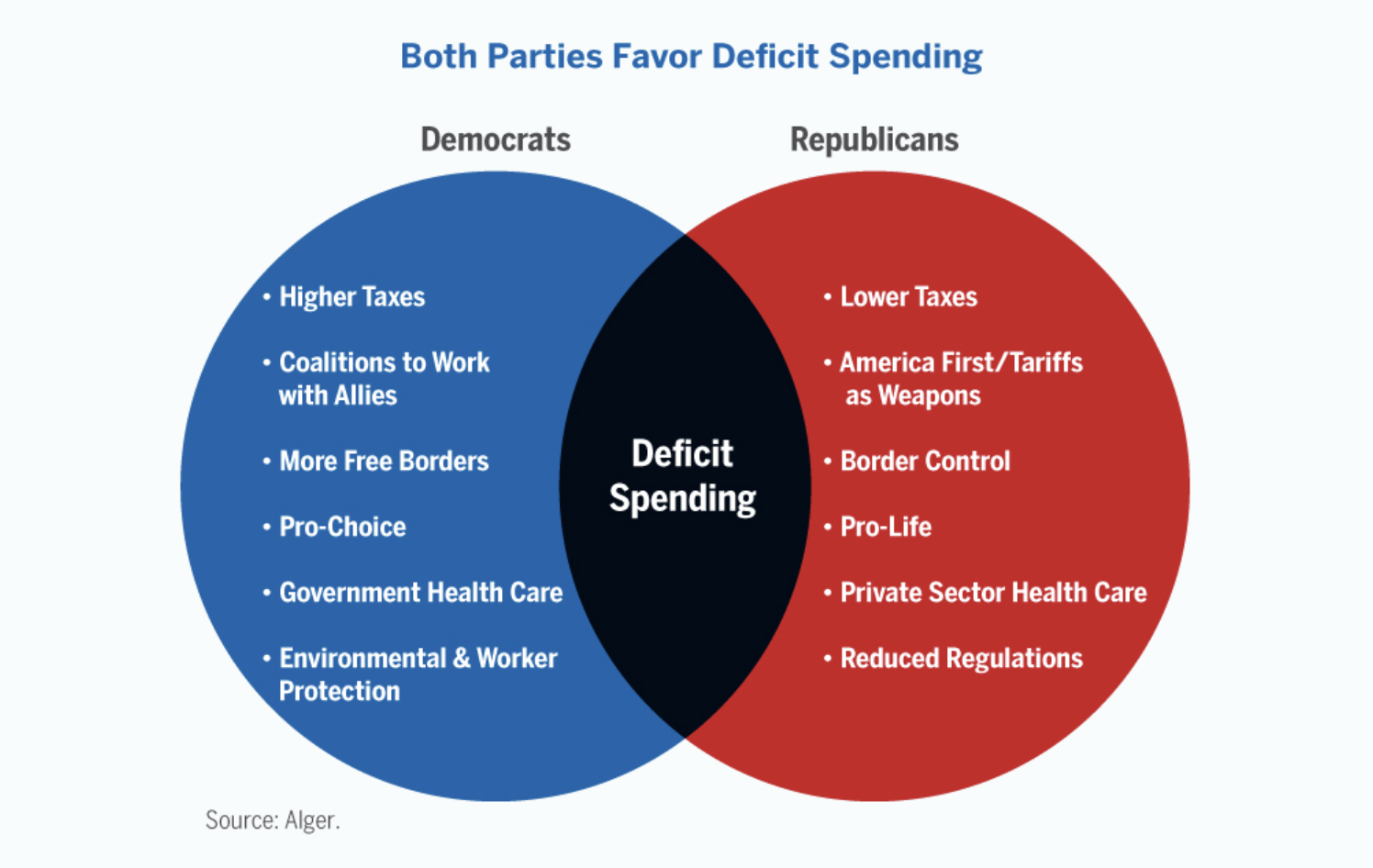

Alger also highlights that while the parties have different priorities, they both agree on deficit spending and fiscal spending is necessary, which may benefit the stock market.

Of particular note is their downloadable presentation packed with investment insights related to drivers beyond the election, like this one: Despite the pandemic, the U.S. consumer savings rate keeps going up – a good leading indicator for future stock purchases.

WHAT ASSET MANAGERS ARE DOING WELL: ALGER FUNDS

-

Visible Thought Leaders

Through its simply presented, well-illustrated content, Alger Funds has become one of the more visible thought leaders in advisor and investor communications on Linkedin, Twitter and especially Financial Advisor IQ ThinkTank (free registration required). -

Thinking Beyond the Election

Encouraging investors to think beyond the election, Alger has made it easier for potential investors to consider the industries and companies that are likely to benefit from this unusual era: Likely winners include technologies that support digital transactions, cloud computing and Artificial Intelligence. “Studies have shown and our research demonstrates that the most innovative companies grow their sales, earnings, and stock prices faster than less innovative companies.”