Keeping investors calm during volatility is an art and a science, and it’s a never-ending challenge for asset managers and advisors alike – especially in a year like 2020.

For a nitty-gritty indicator of the investor mood, few indexes can beat CNN Business’s Fear & Greed Index. CNN explained why “Fear” is driving the market now: “During the last two years, the S&P 500 has typically been further above this average than it is now, indicating that investors are committing capital to the market at a slower rate than they had been previously.”

Franklin Templeton: “Here’s What an Economic Recovery Would Look Like”

Franklin Templeton (FT) built an ambitious investor communications platform – The Franklin Templeton-Gallup Economics of Recovery Study – a large-scale research effort that “will combine monthly surveys of U.S. adults with big data to capture Americans’ readiness to resume pre-COVID-19 behaviors,” according to the site.

Sound too wonky? Keep scrolling. Soon you’ll find yourself in “Findings,” where you’ll read about how other investors are surviving and adapting during this unusual era. “Multimedia” features an 11-minute video on one traditional equity alternative – bonds.

“While there are many unknowns regarding the coronavirus’s impact on the bond market, there are also many misunderstandings,” says Sonal Desai, Ph.D., CIO of Franklin Templeton Fixed Income.

WHAT FRANKLIN TEMPLETON DOES WELL:

Make the most of every channel available

Most of the Economics of Recovery Study findings are repurposed on LinkedIn, YouTube and Facebook. FranklinTempletonTV has also added curated playlists for investors looking for more educational resources or market perspectives from FT’s portfolio managers.

Investor immersion

From the Economics of Recovery Study findings to numerous insights and downloads, it’s easy to navigate to FT’s conventional Investments & Solutions and Tools & Resources pages, where the section on Market Volatility has enough fact-filled, graphically charged illustrations to keep even the wariest shareholder engaged and motivated to stay put until better days ahead.

Hartford Funds: While There Are Reasons Not to Invest, Here’s Why You Should

Hartford Funds content is regularly featured in FA-IQ Think Tank, a thought leadership site that measures the popularity of white papers, microsites, and themes favored by wealth managers and investment advisors. Among its efforts to reduce the fear factor in calamity-minded investors is Hartford Funds’ popular Client Conversations piece.

Looking across four decades of equity performance, Hartford Funds notes, “One year after each of the S&P 500 Index’s 10 worst one-day drops (prior to 2020), the Index notched double-digit positive returns in all but one instance—and remained positive three and five years later, too. This is a hopeful sign for long-term investors….”

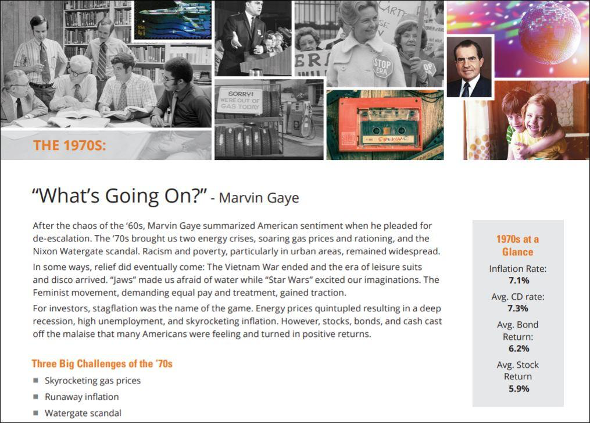

Hartford Funds further tackles the calamity conundrum in “Are Things Today as Bad as They Seem?” While baby boomers may be the only ones who pick up the Bob Dylan references, the section still offers clarity to anyone trying to learn the lessons of performances past.

To prepare for difficult times, Hartford Funds urges investors to download “The Times They Are A-Changin’. But Are They?” which takes the reader on a nostalgia-filled romp through six decades of music, social change and memories. Each decade is rounded out by a summary of key economic facts, the decade’s three biggest challenges and a performance chart.

WHAT HARTFORD FUNDS DOES WELL:

Convince investors that facing the facts is good for them – and their portfolios

Hartford Funds wraps up its journey through the decades with three bracing takeaways and proof statements, including #2: “Resist the Urge to Panic: The challenges we’ve faced in each decade have been steep—but our nation, our economy, and our financial markets are resilient.”

Manage investor anxiety

Hartford Funds provides detailed tutorials and guidelines to help financial advisors talk their clients off the ledge. In “The Price of Panic,” investors are encouraged to “talk to your financial advisor to hear their perspective on this crisis,” and they’re given resources on where to find one.

T. Rowe Price: Valuable Perspectives on Volatility

Google “How volatile is the 2020 stock market?” and an ad for T. Rowe Price appears, pointing to its personal investing site, T. Rowe Price Insights. Crisis-minded investors looking for an information palliative will find much here to calm their nerves. Mark Vaselkiv, T. Rowe Price’s CIO, provides a global approach to mitigating risks in U.S.-centric portfolios.

“Ten Lessons From Ten Years” delivers the details on a decade of international investing to pursue an attractive level of risk-adjusted return from Portfolio Manager Federico Santilli, who ends on an encouraging note: “Whatever happens, we resist the temptation to view market conditions as ‘extraordinary’—requiring a new investment approach that isn’t grounded in business or economic fundamentals.”

WHAT T. ROWE PRICE DOES WELL:

Simplify subscriptions

Every page contains clearly marked banners for subscribing to T. Rowe Price Insights, which offers monthly retirement guidance, financial planning tips and market updates.

Tweak financial priorities during a pandemic

Beyond investments, T. Rowe Price’s Judith Ward provides an excellent framework to help frazzled investors cope with the distracting details of their financial affairs.

Ms. Ward even creates an empathetic bond with readers by relating her own planning issues during the pandemic: “My husband has already stopped working and is used to his daily routine. I’ve realized that I will need to find ways to fill my time once I retire. What will we do together? What will we do separately? Will we stay in our home, relocate, or downsize?”