To many investors, the idea of introducing alternative investments into their portfolio is almost as scary as the prospect of having to delay retirement. But that’s really just fear of the unknown. Most simply haven’t been given the opportunity to understand how alternatives can fit into their investment strategies. That’s where you come in.

Clear and timely articles, videos, and marketing materials can help tell a better story—one in which alternative investments have historically helped limit potential downside risk and accelerate portfolio recovery once markets turn back into positive territory.

Here’s how to effectively introduce alternative investments.

#1 Counter fear with facts.

Use historical data to show how alternatives can be used to offset risk in portfolios.

Why it’s important:

Educates investors on alternatives’ potential to replace stocks and bonds in portfolios as a way of effectively managing risk.

What to do:

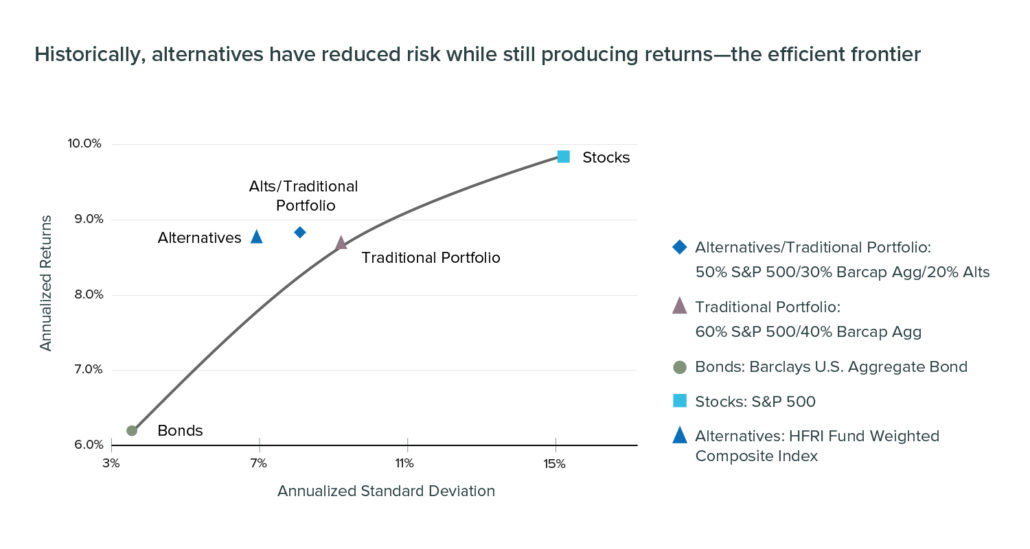

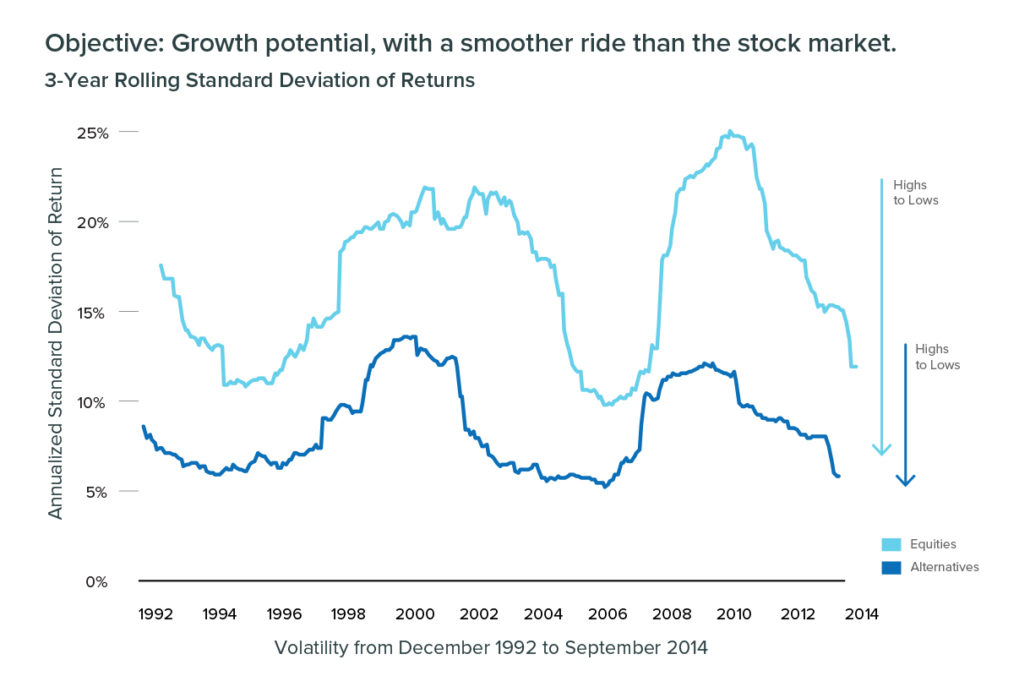

Develop a brief advisor guide with strong visuals that illustrate the performance of alternative investments versus traditional strategies in relation to real market volatility.

Show a visual comparison of alternatives’ performance against traditional investments.

#2 Educate advisors.

Teach advisors how to confidently talk with clients about alternatives.

Why it’s important:

Provides advisors with the know-how they need to be successful—and gives them more reason to rely on your firm.

What to do:

Create an alternatives knowledge center where advisors can learn new skills and connect with peers on alternative investing strategies.

Before talking about alternatives, reconfirm your clients’ goals, time horizon, and risk tolerance. This fundamental information will come into play when considering whether alternatives are right for them.

How to introduce alternatives to your clients:

“Alternative investments are likely to help a portfolio withstand severe market downturns.”

“They can provide better diversification, helping reduce volatility.”

“Liquid alternatives provide the benefits of alternative investments in the familiar mutual fund structure.”

“These investments can be complicated. It’s important to discuss the benefits and risks of investing in alternatives.”

How to address client concerns that all alternatives are high risk:

“Alternatives are similar to traditional assets in that they are subject to risks and will outperform and underperform at different times.”

“The goal is to determine what may work within your portfolio to potentially improve diversification and risk management.”

How to address questions about transparency of alternatives:

“In the ‘40 Act structure, holdings and performance will be reported as they are with other mutual funds. You will want to familiarize your clients with the indices that liquid alternatives are compared against.”

#3 Make the case for alternatives.

Show how alternatives can function in a portfolio to help achieve investing outcomes.

Why it’s important:

Raises advisors’ comfort level with alternatives, preparing them to confidently lead more in-depth client conversations.

What to do:

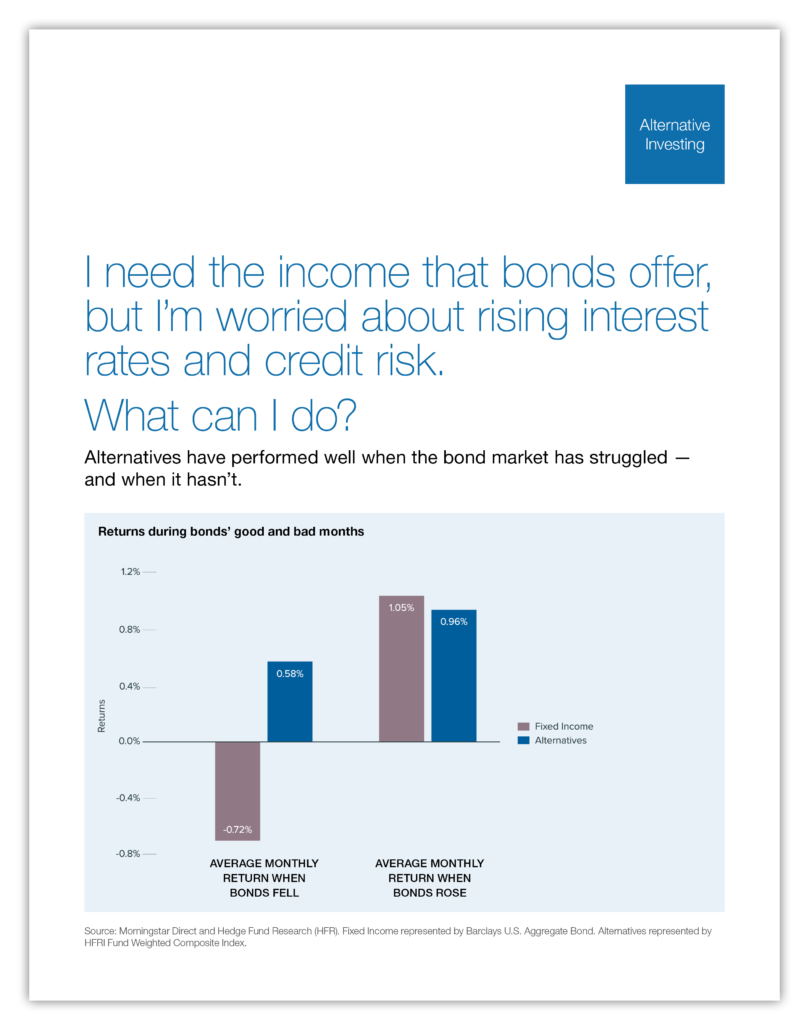

Develop a client-ready one-pager that graphically shows how alternatives meet a client objective.

#4 Show how to add alternatives to a portfolio.

Give detailed guidance on the impact of adding alternatives to a portfolio.

Why it’s important:

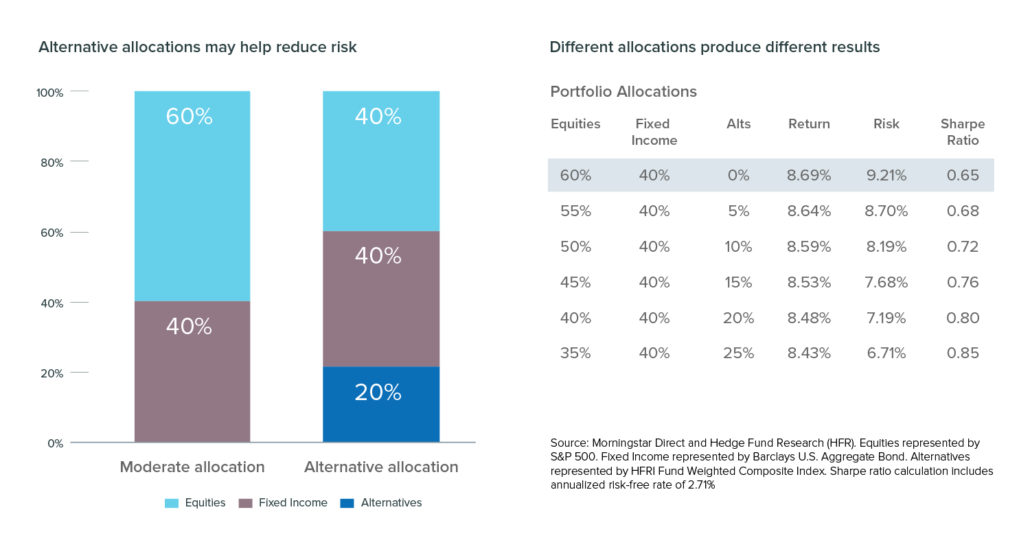

Informs advisors and gives them what they need to manage clients’ expectations by demonstrating ways alternatives can be allocated into portfolios.

What to do:

Create a one-pager that illustrates a “before” and “after” portfolio with details on the impact of risk and return

#5 Create client-ready materials.

Develop easy-to-understand presentations, articles, and videos advisors can access and use.

Why it’s important:

Makes advisors’ jobs easier by helping them showcase the value they bring and the peace of mind they deliver.

What to do:

Create simple, plain-English materials that speak directly to clients’ objectives and pain points.

Need a digital agency that knows alternatives? Ulicny can help.

For over 20 years, we have served some of the most respected alternative investment brands in our industry. So we understand the markets, the technical aspects of alternatives, and your business and investors.

Let us show you how we can help you.