Instagram started a decade ago as a way to share photos. Today, with a billion active users, it has become one of the most popular, fastest-growing social media platforms.1

So it’s not surprising that businesses have started using it to connect with consumers. According to the numbers, that strategy is working. Ninety percent of Instagram users follow at least one business,2 and 80% report they use the platform to make buying decisions about products and services.3 And yet, the power of Instagram has so far been recognized by only a few asset managers.

Why asset managers shouldn’t overlook Instagram

How does a platform that seems to cater to fashion influencers and people sharing selfies fit in for asset managers looking to reach investors and build their brand? There are three basic ways to use Instagram to connect with your intended audiences.

- Photos: This is how Instagram got its start, and it’s still an important way to share your updates. Think photos of your team—or a graphic providing insight into recent market changes.

- Stories: These can combine images, graphics, and text. They live on your Instagram profile for 24 hours and can provide followers with an engaging snapshot of your activities. Think short montage on how your team has been serving clients through the pandemic. One big advantage to using Stories is that they automatically appear at the top of viewers’ feeds, so your story prominently appears regardless of Instagram’s content algorithm. About half of all Instagram users access Stories every day,4 and a third of the top-viewed Stories come from businesses.5

- Videos: This is a big growth area for Instagram content. Think senior leaders from your organization sharing brief views on the markets and economy.

Developing deeper investor connections

I recently spoke with Laura Holland, an expert on social media use by asset management firms, who offered a few ideas and perspectives.

“Although Instagram may seem like a superficial platform, it can really give you some good insights on what the general public is thinking, and that can help you anticipate trends going forward.”

Holland observes that some firms are doing this through polls, which they set up using Instagram Stories. She said companies use these polls to take investors’ pulse on issues that matter to them, asking, for instance: “Do you think X is going to affect the economy—yes or no?”

“It’s such a massively untapped platform for asset management firms, and I think as the newer generation of wealth managers, fund buyers, and portfolio managers come through, you’ll see their adoption of Instagram will really increase.”

Goldman Sachs: Modernizing investor communications

Another way companies can stand out on Instagram is by making it easy for investors to find and engage with in-depth content and perspectives. One company Holland sees as doing this effectively is Goldman Sachs.

She points to recent cultural changes at that firm, which are starting to be reflected in how they communicate on social media. Holland attributes this shift to their CEO, David Solomon, who joined in 2018.

For instance, she explained, the firm now uses Instagram Stories to promote their “Exchanges” podcast, providing a direct link for followers to listen on Spotify—a good example of cross-platform integration, Holland points out.

Which asset managers are leading on Instagram

Capital Group, Vanguard, and BlackRock are three prominent examples of firms using Instagram to showcase their ideas and views on the markets and economy, as well as their human sides.

Capital Group

Capital Group’s lifeatcapitalgroup celebrates team members’ accomplishments, features employee photos, shows their philanthropic efforts, and provides a link to their careers page. Since the pandemic started, the account also features photos of employees working from home.

Vanguard

Vanguard uses a similar approach with lifeatvanguard, spotlighting employees, offering short videos on the company’s mission and culture, featuring perspectives on staying healthy during quarantine, and highlighting their team’s volunteer efforts.

Holland notes that this is becoming the norm: “I’m seeing a lot of humanity- and charity-based posts on Instagram, and I believe it’s because it falls into conscious communication, which is going to be a huge trend.”

Additionally, Vanguard uses a separate account (vanguardgroup) to offer perspectives on the markets—including market volatility updates related to COVID-19—resources for financial literacy, and encouragement for investors to “Stay the Course.”

The firm effectively uses the Highlights feature—the colorful circles that run horizontally above posts on Instagram—to organize their content and make it easy for investors to engage with topics they find interesting.

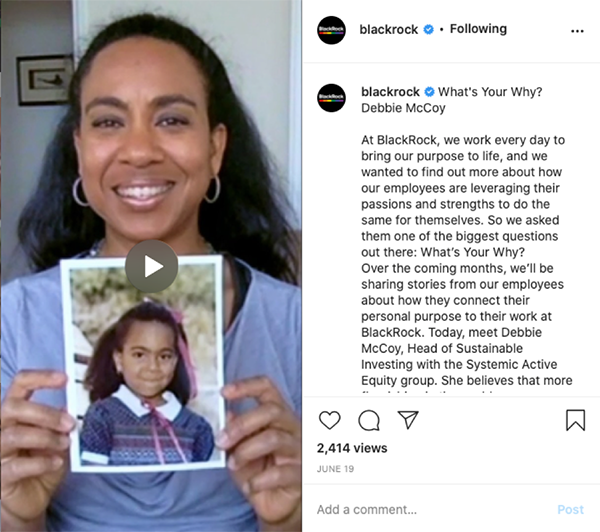

BlackRock

Holland points out that IGTV may present yet another interesting opportunity for firms to effectively use Instagram to connect with investors, since the video features allow you to share more in-depth views and perspectives. It’s also worth noting that, since the beginning of the pandemic, Instagram users are tuning in to more videos than ever before, driving usage of IGTV up 70% in the U.S.6

Additionally, Instagram recently enhanced IGTV, so you can watch and comment on a live stream, then access a recording of that stream later. This may help make Instagram more of a go-to place for video content. And the fact that those videos can stay available indefinitely—they used to automatically disappear after one day—means it’s possible for firms’ compliance teams to keep track of the content.

These new video features represent one of many interesting possibilities for asset managers looking to expand their horizons, and their audiences, through Instagram.

One more reason to consider doing this? Today, the Instagram user base skews to 34 and younger—but projections show that in the coming decade, that demographic will shift significantly, creating new opportunities to connect more broadly with investors.

- https://www.oktopost.com/blog/2019-social-media-trends

- https://business.instagram.com

- https://www.facebook.com/business/news/insights/how-instagram-boosts-brands-and-drives-sales

- https://techcrunch.com/2019/01/30/instagram-stories-500-million

- https://embedsocial.com/blog/instagram-stories-analytics

- https://www.businessinsider.com/instagram-live-70-percent-increase-social-distancing-psychologist-explains-2020-4