Ernst & Young recently conducted their Global Alternative Fund Survey and it revealed a number of useful insights for alternative investors and money managers.

The 53-page report is overflowing with data and perspectives gathered from 226 managers and 61 institutional investors. Here are three noteworthy insights we took away.

Talent is a top concern

While investors and managers listed market volatility and interest rates as among their chief concerns, they also named another significant worry at the top of their list: attracting and retaining talent.

What are the implications? Given how important it is for managers to demonstrate their alts experience and expertise to investors, it’s not surprising that 75% of those surveyed said their top talent priority is retaining the people they need to successfully operate their firms.

Source: 2022 Global Alternative Fund Survey, Ernst & Young Global Limited

Allocations are steady—but for one outlier

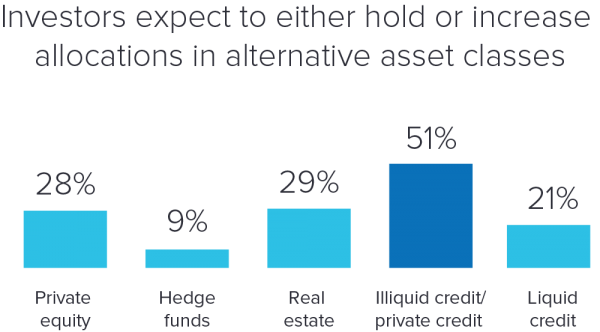

Another key insight from the E&Y report shows how alts asset managers and investors are looking at allocations. While many said they’re keeping them steady, one area that seems to be attracting higher in-flows is private credit.

It appears this surging interest in the asset class may be tied to…surging interest (rates, that is) and the conditions arising from higher borrowing costs that could bring greater investment opportunities in this area.

Source: 2022 Global Alternative Fund Survey, Ernst & Young Global Limited

Private equity is offering more opportunistic investments

As alts managers weigh their options amid uncertainty and volatility, many continue to stick with what they do best: offering hedge, private equity, credit, and real estate.

One exception is private equity managers who say they’re increasing opportunistic and special-situation investment offerings by 33%. This shift appears to be driven by alts investors, 50% of whom said they are looking to increase allocations to one or more strategies.

Source: 2022 Global Alternative Fund Survey, Ernst & Young Global Limited

Ulicny Financial Communications has been helping top alternatives brands reach investors in proven and innovative ways for over 20 years. To help you stay connected to the latest trends and developments in our industry, we bring you insights like the ones in this article. For more, please follow us on LinkedIn.