To address shifting investor expectations, asset managers are becoming more creative in the content and delivery of their six-month updates. The result: Clients can more easily access their midyear update on their preferred device, platform or app.

Our shared humanity emerged as a branding position for asset managers this year, especially on social media. Ulicny’s Courtney McQuade pointed out recently that “firms that effectively use social platforms to build their brand and increase loyalty usually understand one thing: People want to connect with other people, not with corporations.”

Here’s how four asset managers have crafted midyear messages into digital experiences.

Fidelity: Zoom’s rough edges a plus

Fidelity dropped suit, tie, and business setting for this 3:48-minute midyear update from SVP Dirk Hofschire. About as blurry as CNN on location, short, underproduced videos like these can engage viewers with an on-location, emotional honesty that seems straight out of Italian Neorealism.

Mr. Hofschire leads viewers through a crisply executed financial narrative.

Viewers can quickly scan key takeaways from the six-month viewpoint and access a longer webinar accessible from a landing page packed with resources.

Additionally, Fidelity makes available its social media toolbox for LinkedIn, Twitter, and YouTube. @FidelityAdvisor leads to more specialized multimedia content from scores of portfolio managers on Twitter that investors can follow, retweet, or direct message.

- Connect with investors

Social media content from portfolio managers reduces the digital distance between investors and Fidelity. - Offer a broad range of content

The midyear report landing page is easy to navigate and encourages exploration through webinars, calls, white papers, and business cycle updates.

Capital Group: “The Team” surrounds investors

Capital Group’s midyear outlook page packs a visual punch as it invites visitors to meet portfolio team members Rob Lovelace, Joyce Gordon and Mike Gitlin for insights, expertise, and assurance.

In addition to offering engaging commentaries, a webinar (requires login), and other resources, Capital Group keeps the visitor scrolling to its newsletter sign-up section and social media sites.

Capital Group’s Facebook page leads to a 2:20 minute video from Chairman and CEO Tim Armour discussing the COVID-19 moment. With an eye on attracting next-gen investors, Capital Group also recently launched an Instagram feed.

- Encourage investors

Simple and direct headlines like “Expect peaks and valleys on the road to recovery” and “Tough times have birthed some of the world’s leading companies” remind readers to “Buck up, and together we will get through this.” - Deliver across platforms

The firm’s LinkedIn, Facebook and Twitter feeds do a good job of extending its professional expertise from the midyear landing page to each reader’s favorite social media platform. On LinkedIn, for example, readers are invited to “meet a few of our associates.”

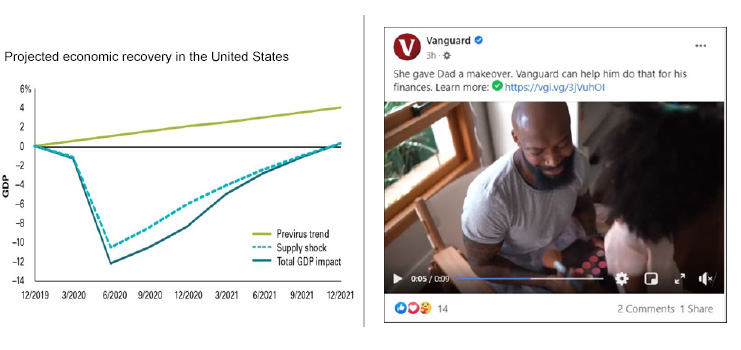

Vanguard: Take a seat in a world-class economic forum

If a midyear report could be a fireside chat, it would be Vanguard’s economic and market outlook: A midyear update. Using an engaging economic forum approach, this update shares the insights of Vanguard’s global economists Joe Davis, Peter Westaway, Qian Wing, and Roger Aliaga-Diaz. Their informal dialogue supports a series of charts that detail routes to economic recovery.

Vanguard’s social media strategy includes highly polished pages on Facebook, YouTube, Twitter and LinkedIn, as well as its branded mobile app, Vanguard blog, Vanguard News, and RSS feeds.

- Deliver a good story

Vanguard’s relaxed, conversational approach brings investors and portfolio managers closer together and makes the six-month review easy to follow and engaging. - Reward further exploration

More of a micro-site than a landing page, the midyear update leads to an abundance of resources for related news and email subscriptions, and also links to the video library for more research and commentary.

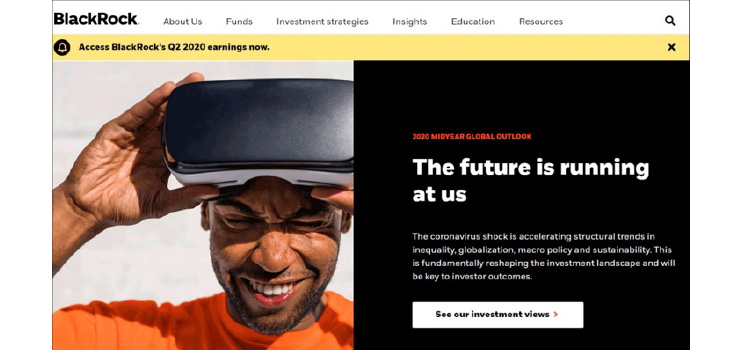

BlackRock: Looking beyond pandemic fault lines

For contemporary immediacy, BlackRock’s 2020 Midyear Global Outlook is hard to beat. With a youthful, hard-edged attitude, BlackRock took a deep dive into today’s zeitgeist and came up optimistic.

The opening salvo sets the stage: “The coronavirus shock is accelerating structural trends in inequality, globalization, macro policy and sustainability. This is fundamentally reshaping the investment landscape and will be key to investor outcomes.”

Readers can choose whether to view the report online or download it as a document or presentation—before following BlackRock on social media, where midyear reporting leads to detailed ways the firm intends to optimize investment outcomes

- Offer actionable insights

BlackRock’s Midyear Global Outlook includes a unique, transparent, inside look at portfolio management’s thinking. The page 16 infographic, “Tactical granular views,” clearly details forward-looking statements about under- and overweights to portfolio positions. - Promote inclusion

Through Facebook and Twitter, BlackRock extends themes introduced in its Midyear Global Outlook to invite visitors to personalize the BlackRock experience for themselves.